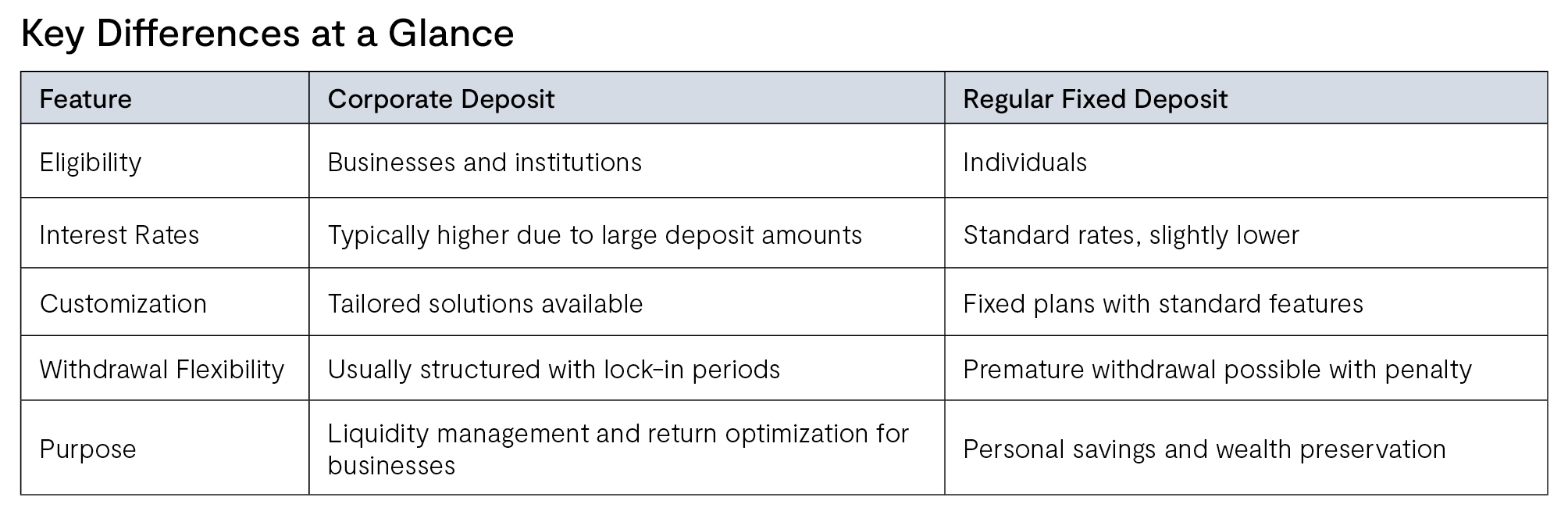

When it comes to securing financial stability and maximizing returns, businesses and individuals in the UAE have various savings options at their disposal. Among the most popular are Corporate Deposits and Regular Fixed Deposits. While both offer a safe avenue for earning interest, they serve different purposes and cater to distinct financial needs. Let’s explore the key differences to help you choose the right option.

Corporate Deposits are specialized savings instruments designed for businesses and institutional clients. These deposits allow companies to park surplus funds in a safe and interest-bearing account, optimizing their liquidity while generating returns.

Higher Interest Rates: Typically, financial institutions offer better returns for corporate deposits due to larger deposit amounts.

Flexible Tenures: Companies or businesses can choose short or long-term deposit plans depending on cash flow needs.

Customizable Solutions: Tailored financial products with structured interest payouts and reinvestment options.

Liquidity Management: Businesses can align deposit periods with their financial planning and operational needs.

Safety and Security: Deposits are held with regulated financial institutions, ensuring capital protection.

A Regular Fixed Deposit (FD) is a financial product that allows individuals to deposit a fixed sum of money for a predetermined period, earning interest at a fixed rate. It is a preferred option for risk-averse investors looking for stability and guaranteed returns.

Key Features of Regular Fixed Deposits:

Fixed Tenure & Returns: The deposit is locked in for a set period, offering guaranteed interest.

Competitive Interest Rates: Returns are stable but may be lower than corporate deposits due to smaller deposit amounts.

Premature Withdrawal Option: Some banks allow early withdrawal with a penalty.

Low Risk & Capital Protection: Ideal for individuals who prioritize safety over high returns.

Multiple Tenure Options: Choose from short, medium, or long-term plans based on financial goals.

Understanding the difference between Corporate Deposits and Regular Fixed Deposits is crucial in making informed financial decisions. Whether you’re a business seeking to optimize your funds or an individual looking for stability, Deem Finance offers tailored corporate deposit solutions designed to meet your unique business needs.

Explore Deem corporate deposit options today and make your money work smarter!

© All rights reserved 2026 Deem Finance LLC. Deem Finance LLC (Deem) is regulated by Central Bank of the UAE.